Q1 Revenue up 56%Year over Year

Q1 Bookings up 54% Year over Year

Gross Profit up 294% Year over Year

PALO ALTO, Calif. – May 13, 2024 – D-Wave Quantum Inc., (NYSE: QBTS) (“D-Wave” or the “Company”) a leader in commercial quantum computing systems, software, and services, today announced financial results for its first fiscal quarter ended March 31, 2024.

“D-Wave’s first quarter revenue and bookings reflect growing customer demand for quantum and hybrid quantum solutions that can drive measurable impact today,” said Dr. Alan Baratz, CEO of D-Wave. “Coupled with the significant technical milestones we’ve achieved with the Advantage2TM prototype, we believe our progress leading the commercialization of quantum through our products, customer application development and accelerating adoption is evident.”

Recent Business and Technical Highlights

- Introduced the powerful, new fast-anneal feature, which helps users perform quantum computations at unprecedented speeds, greatly reducing the impact of external disturbances such as thermal fluctuations and noise that often hinder quantum calculations. Leading industry analyst firm IDC noted that “D-Wave’s launch of the fast-anneal feature should be considered just as significant as recent logical qubit and error mitigation announcements from gate-based quantum hardware developers.”[1]

- Recently yielded 4800+ qubit processors for the forthcoming Advantage2 system, which comes on the heels of launching the 1,200+ qubit Advantage2 prototype and making it accessible in the LeapTM quantum cloud service earlier this year. Currently under calibration, the yielding of these 4800+ processors marks an important milestone in our Advantage2 product delivery roadmap.

- Announced a renewed multiyear partnership with the University of Southern California ("USC"); the USC Viterbi School of Engineering will continue to house a D-Wave state-of-the-art Advantage™ quantum computer, facilitating ongoing exploration and adoption of annealing quantum computing solutions for businesses, researchers, and government.

- Worked with customers on a variety of quantum-powered optimization applications including optimizing usage of solar panels in buildings; body shop scheduling for commercial vehicle production; optimizing schedules for crude oil tanker unloading at refineries; and cybersecurity.

- Announced our tenth Qubits quantum computing conference, which takes place June 17th and 18th in Boston, Massachusetts. Themed “Success, Powered by Quantum,” the conference will demonstrate how partners and customers such as Davidson Technologies, Los Alamos National Lab, Mastercard, Momentum Worldwide (part of Interpublic Group), Pattison Food Group, QuantumBasel, SavantX, Unisys and Zapata AI are using D-Wave’s innovative annealing quantum computing technology to solve complex real-world problems.

- First quarter 2024 Bookings (as defined below) totaled $4.5 million, an increase of $1.6 million, or 54%, from Q1 FY23 bookings, representing the Company’s eighth consecutive quarter of year-over-year growth in quarterly bookings.

First Quarter Fiscal 2024 Financial Highlights

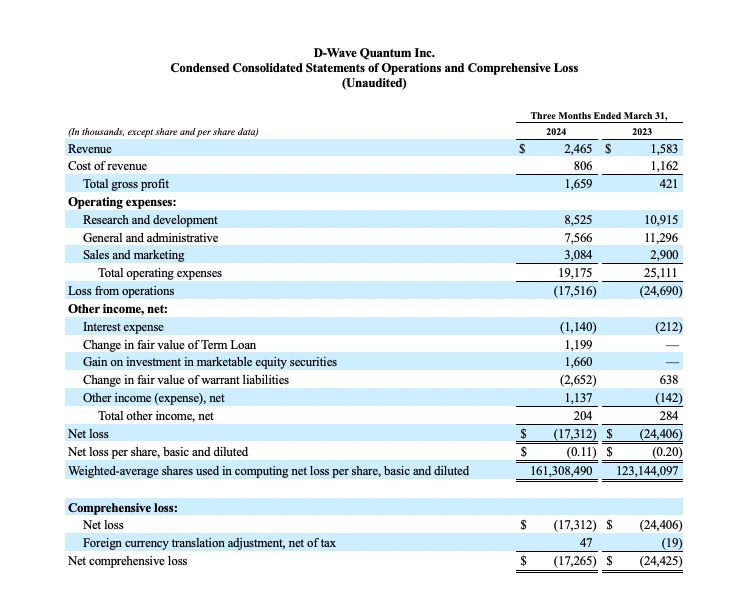

- Revenue: Revenue for the first quarter of fiscal 2024 was $2.5 million, an increase of $0.9 million, or 56%, from the fiscal 2023 first quarter revenue of $1.6 million.

- Bookings1: Bookings for the first quarter of fiscal 2024 were $4.5 million, an increase of $1.6 million, or 54%, from the fiscal 2023 first quarter Bookings of $2.9 million. This represents D-Wave’s eighth consecutive quarter of year-over-year growth in quarterly bookings.

- Customers: In comparing the most recent four quarters with the immediately preceding four quarters, D-Wave had:

- A total of 128 customers compared with a total of 113 customers;

- 75 commercial customers compared with 69 commercial customers; and

- 25 Forbes Global 2000 customers compared with 22 Forbes Global 2000 customers constituting 33% of the total number of commercial customers.

- Commercial Traction: In comparing the most recent four quarters with the immediately preceding four quarters:

- Revenue from commercial customers increased by $2.2 million, or 51%;

- Commercial revenue as a percentage of total revenue increased from 63% to 69%; and

- Revenue from Forbes Global 2000 customers increased by $0.9 million, or 50%, and comprised 27%of total revenue.

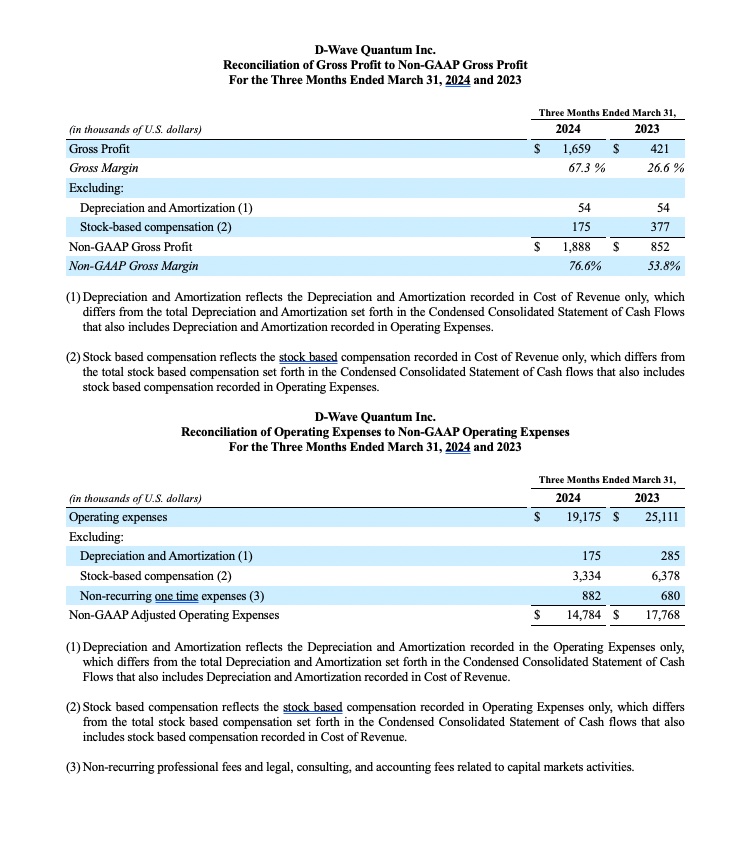

- GAAP Gross Profit: GAAP gross profit for the first quarter of fiscal 2024 was $1.7 million, an increase of $1.3 million, or 294%, from the fiscal 2023 first quarter gross profit of $0.4 million, with the increase due primarily to the growth in revenue and increased operating efficiencies.

- GAAP Gross Margin: GAAP gross margin for the first quarter of fiscal 2024 was 3%, an increase of 40.7% from the fiscal 2023 first quarter GAAP gross margin of 26.6% with the increase due primarily to the growth in revenue and increased operating efficiencies.

- Non-GAAP Gross Profit2: Non-GAAP gross profit for the first quarter of fiscal 2024 was $1.9 million, an increase of $1.0 million, or 122%, from the fiscal 2023 first quarter non-GAAP gross profit of $0.9 million. The difference between GAAP and non-GAAP gross profit is limited to non-cash stock-based compensation and depreciation expenses that are excluded from the non-GAAP gross profit.

- Non-GAAP Gross Margin2: Non-GAAP gross margin for the first quarter of fiscal 2024 was 6%, an increase of 22.8% from the fiscal 2023 first quarter non-GAAP gross margin of 53.8%. The difference between GAAP and non-GAAP gross margin is limited to non-cash stock-based compensation and depreciation expenses that are excluded from the non-GAAP gross margin.

- GAAP Operating Expenses: GAAP operating expenses for the first quarter of fiscal 2024 were $19.2 million, a decrease of $5.9 million, or 24%, from the fiscal 2023 first quarter GAAP operating expenses of $25.1 million with the decrease driven primarily by a decrease of $3.0 million in non-cash stock-based compensation expense, $2.2 million in professional services and $0.5 million in marketing costs.

- Non-GAAP Adjusted Operating Expenses2: Non-GAAP adjusted operating expenses for the first quarter of fiscal 2024 were $14.8 million, a decrease of $3.0 million, or 17% from the fiscal 2023 first quarter non-GAAP adjusted operating expenses of $17.8 million with the decrease driven primarily by a decrease of $2.2 million in professional services and $0.5 million in marketing costs.

- Net Loss: Net loss for the first quarter of fiscal 2024 was $17.3 million, or $0.11 per share, a decrease of $7.1 million, or $0.09 per share, from the fiscal 2023 first quarter net loss of $24.4 million, or $0.20 per share.

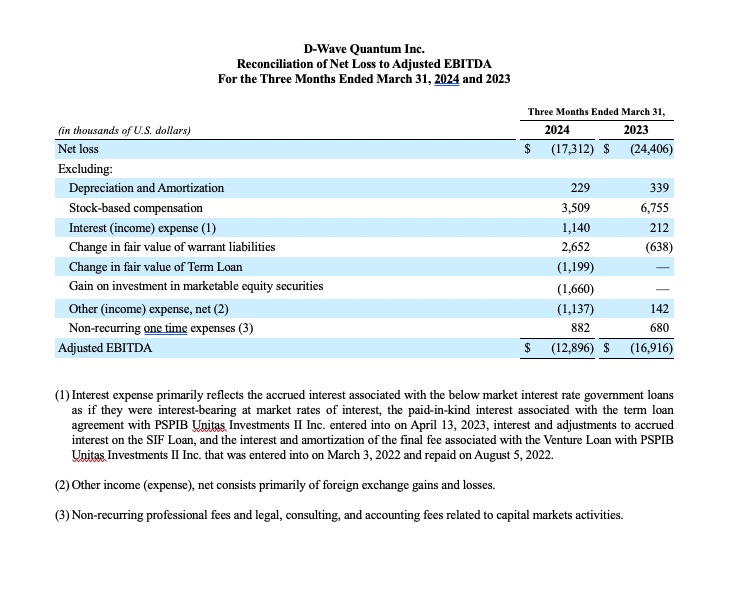

- Adjusted EBITDA Loss2: Adjusted EBITDA Loss for the first quarter of fiscal 2024 was $12.9 million, a decrease of $4.0 million, or 24%, from the fiscal 2023 first quarter Adjusted EBITDA Loss of $16.9 millionwith the improvement due primarily to higher gross profit and lower operating expenses.

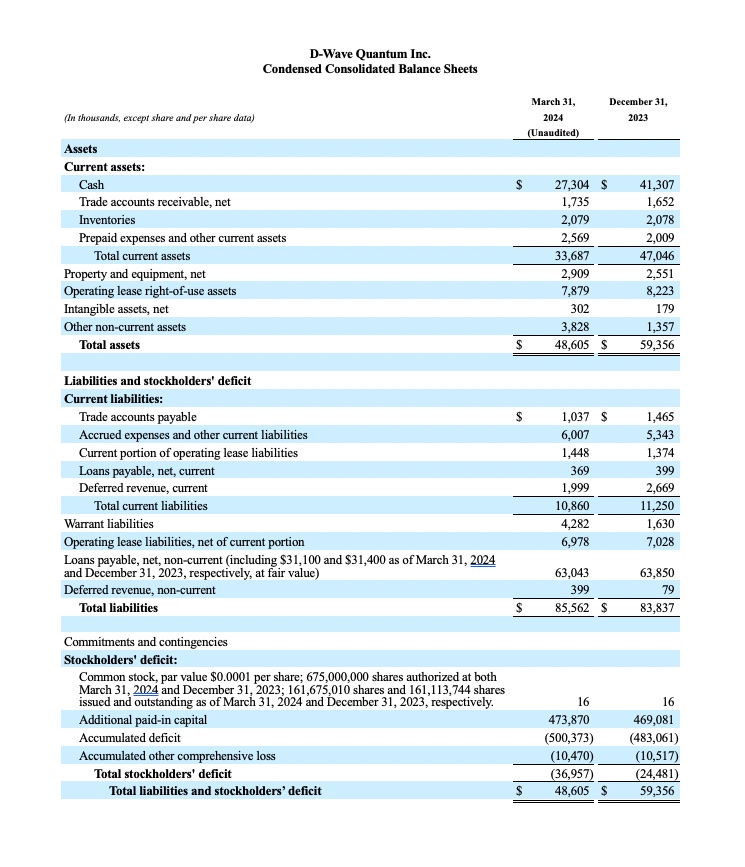

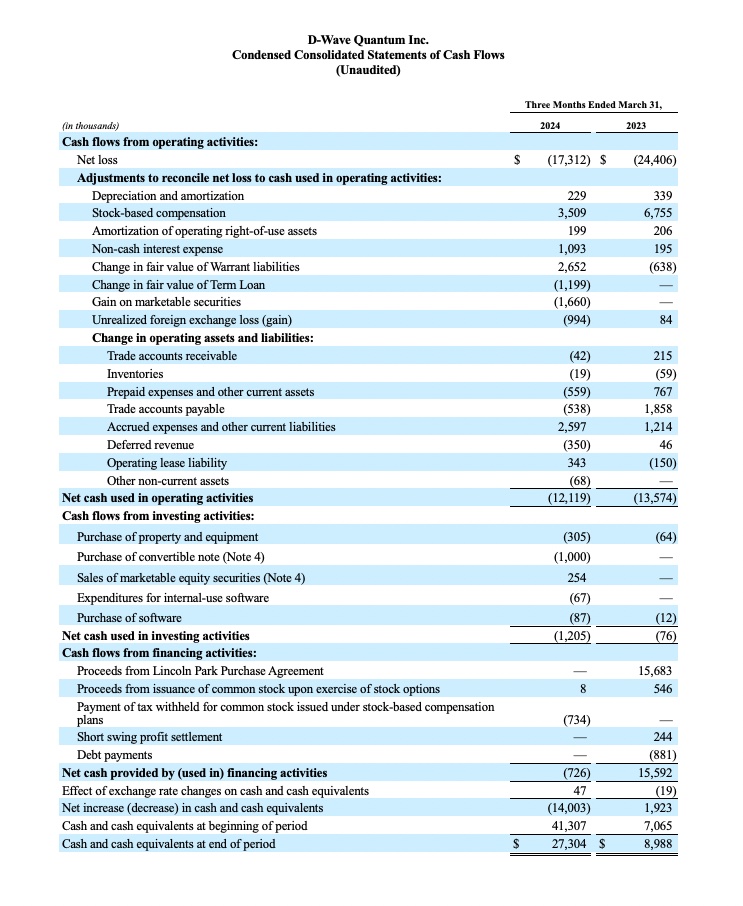

Balance Sheet and Liquidity

As of March 31, 2024, D-Wave’s consolidated cash balance totaled $27.3 million, an increase of $18.3 million, or 204%, from the fiscal 2023 first quarter consolidated cash balance of $9.0 million. As of May 10, 2024, D-Wave's consolidated cash balance was $33 million.

On April 12, 2024, D-Wave’s $175 million shelf registration statement on Form S-3 went effective. On the same date, the Company’s Equity Line of Credit ("ELOC") registration statement on Form S-3 with Lincoln Park Capital Fund, LLC also went effective. As of the effective date, the Company had $82.1 million in available capacity under the ELOC with the investment commitment running through October 2025. D-Wave’s ability to raise additional funds under the ELOC is subject to a number of conditions including having a sufficient number of registered shares and having D-Wave's stock price above $1.00 per share.

Fiscal Year 2024 Outlook

We are reiterating the full year 2024 financial guidance set forth in our March 28, 2024, fiscal 2023 fourth quarter and full year earnings press release. Our guidance is subject to various cautionary factors described below. Based on the information available on May 10, 2024, guidance for the full year 2024 is as follows:

Adjusted EBITDA

- We expect fiscal 2024 Adjusted EBITDA Loss3 to be less than the fiscal 2023 Adjusted EBITDA Loss of $54.3 million.

___________________

1“Bookings” is an operating metric that is defined as customer orders received that are expected to generate net revenues in the future. We present the operational metric of Bookings because it reflects customers' demand for our products and services and to assist readers in analyzing our potential performance in future periods.

2"Non-GAAP Gross Profit", "Non-GAAP Gross Margin", "Non-GAAP Adjusted Operating Expenses", and "Adjusted EBITDA Loss", are non-GAAP financial measures or metrics. Please see the discussion in the section “Non-GAAP Financial Measures” and the reconciliations included at the end of this press release.

3We are not able to reconcile guidance for Adjusted EBITDA Loss to its most directly comparable GAAP measure, Net Loss, and cannot provide an estimated range of net loss for such period without unreasonable efforts because certain items that impact Net Loss, including foreign exchange and the fair value of warrant liabilities, are not within our control or cannot be reasonably predicted.

Earnings Conference Call

In conjunction with this announcement, D-Wave will host a conference call on Monday, May 13, 2024, at 8:00 a.m. (Eastern Time), to discuss the Company’s financial results and business outlook. The live dial-in number is 1-800-267-6316 (domestic) or 1-203-518-9783 (international). The conference ID is “D-Wave.” Participating in the call on behalf of the Company will be Chief Executive Officer, Dr. Alan Baratz, and Chief Financial Officer, John Markovich.

About D-Wave Quantum Inc.

D-Wave is a leader in the development and delivery of quantum computing systems, software, and services, and is the world’s first commercial supplier of quantum computers. Our mission is to unlock the power of quantum computing today to benefit business and society. We do this by delivering customer value with practical quantum applications for problems as diverse as logistics, artificial intelligence, materials sciences, drug discovery, scheduling, cybersecurity, fault detection, and financial modeling. D-Wave’s technology has been used by some of the world’s most advanced organizations, including Mastercard, Deloitte, Davidson Technologies, ArcelorMittal, Siemens Healthineers, Unisys, NEC Corporation, Pattison Food Group Ltd., DENSO, Lockheed Martin, Forschungszentrum Jülich, University of Southern California, and Los Alamos National Laboratory.

Non-GAAP Financial Measures

To supplement the financial information presented in accordance with GAAP, we use non-GAAP measures of certain components of financial performance. Each of non-GAAP gross profit, non-GAAP gross margin, Adjusted EBITDA Loss and non-GAAP adjusted operating expenses is a financial measure that is not required by or presented in accordance with GAAP. Management believes that each measure provides investors an additional meaningful method to evaluate certain aspects of such results period over period. The Company defines each of its non-GAAP financial measures as follows:

- Non-GAAP gross profit is defined as GAAP Gross Profit less non-cash stock-based compensation expense and depreciation and amortization. We use non-GAAP gross profit to measure, understand and evaluate our core operating performance and trends and to develop short-term and long-term operating plans.

- Non-GAAP gross margin is defined as GAAP Gross Margin less non-cash stock-based compensation expense and depreciation and amortization. We use non-GAAP gross margin to measure, understand and evaluate our core business performance.

- Adjusted EBITDA Loss is defined as net loss before interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation, remeasurements of liability-classified warrants, and other non-recurring non-operating income and expenses. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations.

- Non-GAAP Adjusted operating expenses is defined as operating expenses before depreciation and amortization expense, non-recurring one-time expense and non-cash stock-based compensation expense. We use non-GAAP adjusted operating expenses to measure our operating expenses, excluding items we do not believe directly reflect our core operations.

The presentation of non-GAAP financial measures is not meant to be considered in isolation or as a substitute for the financial results prepared in accordance with GAAP, and our presentation of non-GAAP measures may be different from non-GAAP measures used by other companies. For a reconciliation of non-GAAP gross profit, non-GAAP gross margin, Adjusted EBITDA Loss and non-GAAP adjusted operating expenses to its most directly comparable GAAP measure, please refer to the reconciliations below.

Forward-Looking Statements

Certain statements in this press release are forward-looking, as defined in the Private Securities Litigation Reform Act of 1995. These statements involve risks, uncertainties, and other factors that may cause actual results to differ materially from the information expressed or implied by these forward-looking statements and may not be indicative of future results. Forward-looking statements in this press release include, but are not limited to, statements regarding the potential impact of quantum and quantum hybrid systems; the development and progress of our forthcoming Advantage2 system; the timing and content of the Qubits quantum computing conference; our ability to raise additional funds under the ELOC; the Company's reiterated 2024 financial guidance, as set out in our March 28, 2024 fiscal 2023 fourth quarter and full year earnings press release; the Company's expectations relating to 2024 Adjusted EBITDA Loss; and details of the Company's conference call in conjunction with this announcement. These forward-looking statements are subject to a number of risks and uncertainties, including, among others, various factors beyond management’s control, including general economic conditions and other risks; our ability to expand our customer base and the customer adoption of our solutions; risks within D-Wave’s industry, including anticipated trends, growth rates, and challenges for companies engaged in the business of quantum computing and the markets in which they operate; the outcome of any legal proceedings that may be instituted against us; risks related to the performance of our business and the timing of expected business or financial milestones; unanticipated technological or project development challenges, including with respect to the cost and/or timing thereof; the performance of our products; the effects of competition on our business; the risk that we may not be able to raise additional funds under the ELOC; the risk that we will need to raise additional capital to execute our business plan, which may not be available on acceptable terms or at all; the risk that we may never achieve or sustain profitability; the risk that we are unable to secure or protect our intellectual property; volatility in the price of our securities; the risk that our securities will not maintain the listing on the NYSE; the risk that our restatement of certain previously issued audited and unaudited financial statements or material weaknesses in internal controls could negatively affect investor confidence and raise reputational issues; and the numerous other factors set forth in D-Wave’s Annual Report on Form 10-K for its fiscal year ended December 31, 2023 and other filings with the Securities and Exchange Commission. Undue reliance should not be placed on the forward-looking statements in this press release in making an investment decision, which are based on information available to us on the date hereof. We undertake no duty to update this information unless required by law.

Contacts

Investor Contact:

Kevin Hunt

ir@dwavesys.com

Media Contact:

Alex Daigle

media@dwavesys.com

[1] IDC Link: D-Wave: Improving the Quantum Experience with the Introduction of Fast Anneal, doc #lcUS52073224, April 2024